what food items are taxable in massachusetts

Is Food Taxable In Massachusetts Taxjar Sales Tax. The meals tax rate is 625.

Are Cookies Taxed In Mass Groupersandwich Com

The exemption for food includes.

. Many food items that were. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a grocery.

Massachusetts has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Sales tax on meals is also 625 but in about half of the towns in our region see list here there is also an additional 075 local tax on meals. Food must meet these conditions to be exempt from tax.

Phone numbers for the Sales Tax division of the Department of Revenue are as follows. 2 vitamins and minerals in liquid capsule regular tablet and chewable tablet form. Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more.

Yes if the sales of a food product that is taxable extend longer than 48 hours sales taxes are required to be collected on those food items and remitted. Most items that cost less than 175 are exempt from sales tax including everyday shoes and even shoelaces items. Counties and cities are not allowed to collect local sales taxes.

44 rows In the state of Massachusetts sales tax is legally required to be collected from all tangible. This page describes the taxability of food and meals in Massachusetts including catering and grocery food. Massachusetts has a higher state sales tax than 635 of states.

The Department of Revenue states that meals sold that do not require significant further preparation whether prepackaged or not constitute a meal and the seller is required to collect a sales tax. A convenience or other stores sales of the following items are taxable. The governors staff said the extra revenue will generate more than 65 million a year and that other.

Bakery products baked goods sold in units of six or more for off. It must be sold in the same form and condition quantities and packaging as is. When foods are categorized as necessities based on nutritional value soda and candy are among the first products to be added to the taxable list.

It describes the tax what types of transactions are taxable and what both buyers and sellers must do to comply with the law. This guide is not designed to address all questions which. 3 herb laxative tablets.

Most food is exempt from sales tax. Regulations and exemptions on sales taxretail tax vary by state and even within a. Assume it exempts food items including bakery goods.

Candy IS considered a grocery in Massachusetts. Massachusetts law makes a few exceptions here. These businesses include restaurants cafes food trucks or stands coffee shops etc.

The Massachusetts Sales Tax is administered by the Massachusetts Department of Revenue. You inquire whether sales tax applies to the sale of the following health food items. The budget without raising tax rates Lamont said.

Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. This raises obvious questions about a host of other food items like chips baked goods and ice cream. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is.

It must be sold unheated. To learn more see a full list of taxable and tax-exempt items in Massachusetts. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

I can understand paying tax if Iâm eating there. Below are some of the more interesting ones weve found. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax.

We recommend businesses review the laws and rules put forth by the Massachusetts DOR to stay up to date on which goods are taxable and which are exempt and under what conditions. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. This guide has general information about Massachusetts sales and use tax.

Sales and Use Tax. Back to Massachusetts Sales Tax Handbook Top. Whole Foods charges sales tax on loose bagels up to six the salad bar and some herbal teas.

B The Connecticut retail stores have 400000 in sales 300000 from in-store sales and 100000 from catering and 10000 in delivery charges for catering activities. Massachusetts sales tax liability b. You can learn more by visiting the sales tax information website at wwwmassgov.

Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. Baked goods in units of six or more. The regular Massachusetts sales tax is currently 625 of the purchase price.

It must be sold for human consumption. In many states localities are able to impose local sales taxes on top of the state sales tax. Before August 1 2009 the tax rate was 5.

Poured beverages such as. Sales tax is due on pet foods and supplies sold for use. Groceries and prescription drugs are exempt from the Massachusetts sales tax.

In the state of Massachusetts the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Massachusetts first adopted a general state sales tax in 1966 and since that time the rate has risen to 625 percent. Some types of clothing and footwear which are designed specifically for athletic activities or protective use are considered to be taxable.

Sales tax on food creates Mass.

Massachusetts Sales Tax Small Business Guide Truic

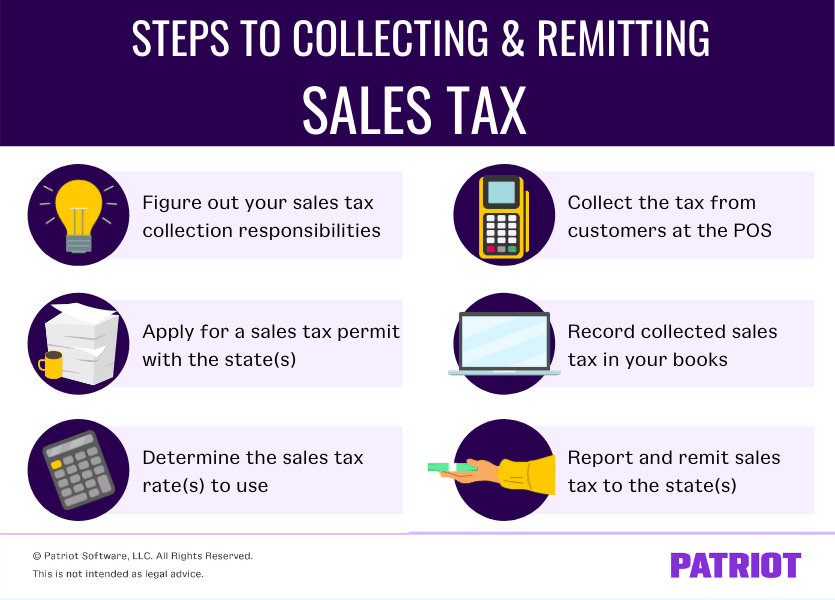

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Tax On Grocery Items Taxjar

20 Rye Sourdough Bread 83 Using Dough Binder Method From Northwestsourdough Works Well 21 Starter 50 Eat Seasonal Naturally Leavened Sourdough Bread

State Sales Tax Will Rise To 7 35 For Prepared Food On Oct 1 Politics Government Journalinquirer Com

Is Food Taxable In Massachusetts Taxjar

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Digesting The Complicated Topic Of Food Tax Article

Taxes On Food And Groceries Community Tax

Taxes On Food And Groceries Community Tax

Pin On Breads Biscuits Muffins

The Crazy Tax Laws Regarding Food Miles Consulting Group

Taxes On Food And Groceries Community Tax

7 Ways To Create Tax Free Assets And Income

Supreme Court Case Will You Have To Pay Sales Tax On Every Online Purchase Npr

Exemptions From The Massachusetts Sales Tax

Sales Tax On Grocery Items Taxjar

Breadsticks Recipe Food Com Recipe Recipes Bread Sticks Recipe Breadsticks

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)